Forex software and their benefits

Forex software is a computer program designed to assist traders in the foreign exchange market. These software programs come in various forms, ranging from basic charting tools to complex trading robots. Forex software provides traders with a range of tools and features to analyze market conditions and execute trades, including automated trading, technical analysis tools, real-time data, backtesting, risk management tools, and 24/7 trading. Forex software simplifies the trading process and allows traders to optimize their trading performance by providing them with up-to-date information on market conditions and a wide range of tools to help them make informed trading decisions.

In this article, we will discuss the benefits of using Forex software in detail.

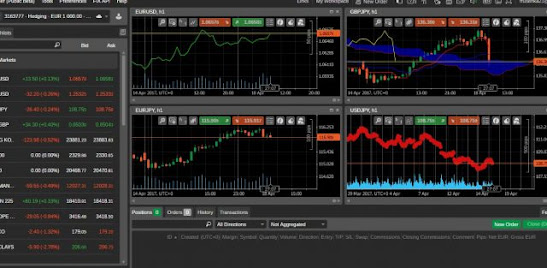

Automated Trading

One of the significant benefits of Forex software is automated trading. This feature allows the program to trade on your behalf, eliminating the need for constant monitoring of the market. Automated trading also helps traders take advantage of market opportunities, even when they are away from their trading desk. Forex software uses advanced algorithms and strategies to analyze market conditions and execute trades automatically. This feature saves traders time and allows them to focus on other aspects of trading.

Technical Analysis

Forex software is equipped with a wide range of technical analysis tools, including charts, indicators, and trend lines. These tools help traders to analyze price movements and identify trading opportunities. Technical analysis is a vital part of trading, as it allows traders to identify trends and patterns in the market. Forex software simplifies the process of technical analysis by providing traders with a wide range of tools and features to analyze market conditions.

Real-time Data

Forex software provides real-time data on currency prices and other relevant information such as economic news releases. This information is crucial for traders to make informed trading decisions. Forex software uses advanced technology to collect and analyze market data in real-time, providing traders with up-to-date information on market conditions. This feature helps traders to make informed decisions based on current market conditions.

Backtesting

Forex software allows traders to backtest their trading strategies using historical market data. This feature helps traders to evaluate the effectiveness of their trading strategies before deploying them in the live market. Backtesting involves simulating trades using historical market data to evaluate the performance of a trading strategy. Forex software provides traders with a wide range of tools and features to backtest their trading strategies, allowing them to refine their strategies and improve their trading performance.

Risk Management

Forex software comes with various risk management tools such as stop-loss orders and take-profit orders. These tools help traders to minimize their losses and maximize their profits. Stop-loss orders allow traders to set a limit on the amount of loss they are willing to incur on a trade, while take-profit orders allow traders to set a limit on the amount of profit they are willing to take on a trade. Forex software also provides traders with risk management tools such as margin calculators and position sizing calculators to help them manage their risk effectively.

24/7 Trading

Forex software allows traders to trade 24/7, even when the markets are closed. This feature is particularly beneficial for traders who are trading in different time zones. Forex software uses advanced technology to execute trades automatically, even when the trader is away from their trading desk. This feature allows traders to take advantage of market opportunities around the clock and increases their trading flexibility.

Customization

Forex software is highly customizable, allowing traders to tailor the software to their individual trading preferences. Traders can customize the software to suit their trading style, including the types of charts, indicators, and strategies they use. Customization is a vital feature of Forex software, as it allows traders to personalize their trading experience and optimize their trading performance.

Trade Management

Forex software provides traders with advanced trade management tools, including order management, trade monitoring, and trade analysis. These tools help traders to manage their trades effectively and make informed trading decisions. Order management tools allow traders to place and manage orders, while trade monitoring tools provide real-time updates on the status of their trades. Trade analysis tools allow traders to analyze their trading performance and identify areas for improvement.

Cost-Effective

Forex software is often more cost-effective than traditional trading methods, such as hiring a broker or paying for expensive trading platforms. Forex software is typically available for a one-time fee or a monthly subscription, making it accessible to traders with various budgets.

Increased Efficiency

Forex software is designed to automate many of the time-consuming and repetitive tasks involved in trading, such as market analysis and order placement. This allows traders to focus on developing and refining their trading strategies and taking advantage of market opportunities, rather than spending hours analyzing data and executing trades manually.

Comments

Post a Comment